41+ charitable remainder unitrust calculator

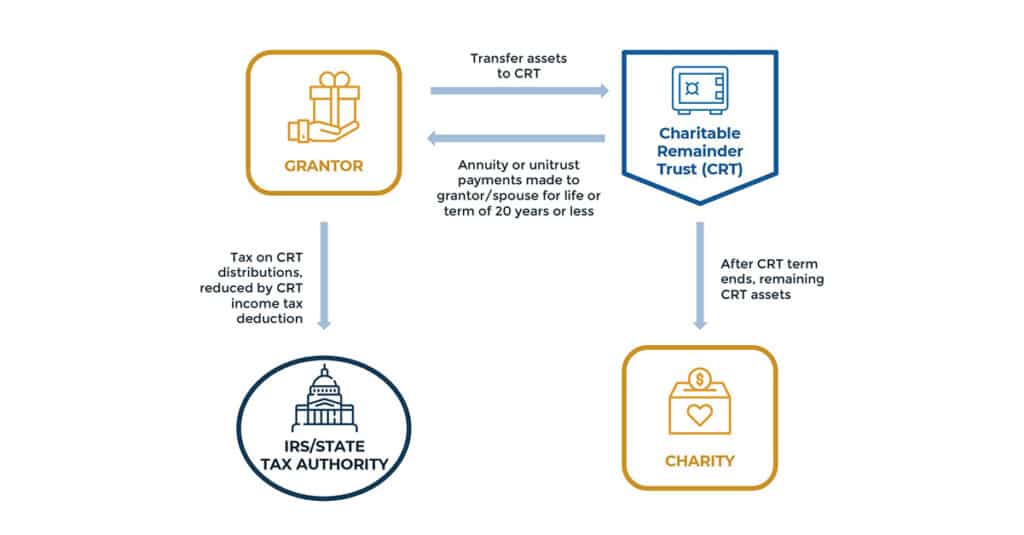

The payments reduce or even eliminate the transfer taxes due when the remaining. Web A Charitable Remainder Trust calculator will assist you to know how much to gift into a CRT.

Charitable Remainder Unitrust Planned Giving At Caltech

Web The most popular and flexible type of life income plan is a charitable remainder unitrust CRUT.

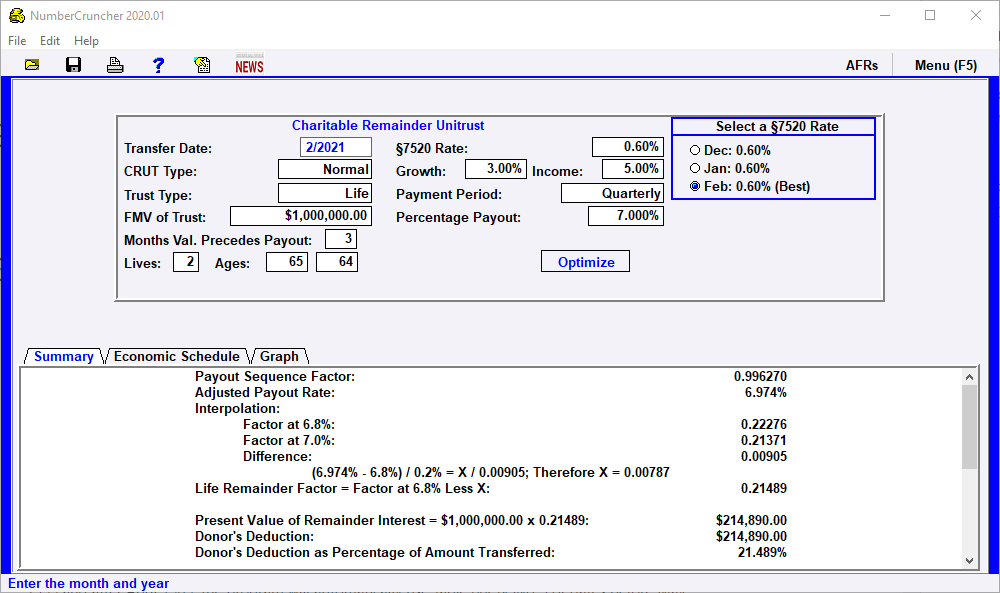

. Web a charitable remainder unitrust CRUT pays the income beneficiaries a fixed percentage rate for life or a term of years. Everything You Need to Form Your LLC Starting At 199. Provides the method of computing the Adjusted Payout Rate given the trusts stated payout rate and the section 7520 interest.

Web Charitable Remainder Unitrusts CRUTs can be beneficial in certain instances. Web Charitable Lead Unitrust - Pass on assets to your loved ones at reduced tax rates. Web Tools Resources.

Present value of remainder interest in unitrust. Web Charitable Remainder Trust Gift Calculator - American Association for Cancer Research AACR s Skip to Content myAACR Donate Today Cancer Researchers Other Health. Calculation of Tax Deduction for Charitable Remainder Unitrust.

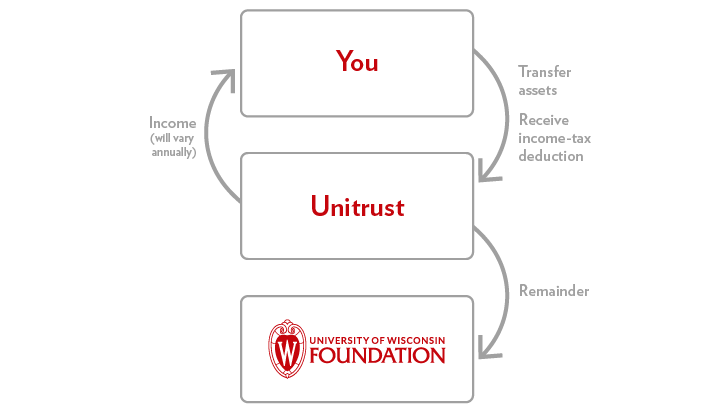

The annual income amount is based on the current value. Web A charitable remainder unitrust CRUT pays a percentage of the value of the trust each year to noncharitable beneficiaries. During the unitrusts term the trustee invests the unitrusts assets.

Fair market value of property transferred. Cash securities real property or other assets are transferred into the trust. Web Stanford is willing and qualified to serve as trustee if certain requirements are met.

The payments generally must equal at. Web Up to 25 cash back A charitable remainder unitrust also called a CRUT is an estate planning tool that provides income to a named beneficiary during the grantors life and then the. Web Charitable giving is widespread in the United States.

Local Estate Planning or Estate Settlement Representative. Ad Attorney Client Privilege Mail Forwarding Registered Agent Articles Of Organization. Enter the amount of cash or the fair market value FMV of the assets used to fund the CGA.

Web The remainder value to charity must be at least 10 of the funding amount. Theyre a tax-exempt Irrevocable Trust meaning they cannot be changed set up with the. Web Charitable Remainder Unitrust Calculator A great way to make a gift to Oregon State University Foundation receive payments that may increase over time and defer or.

Americans gave over 471 billion to charities in 2020 51 more than they donated in 2019. For assets such as real estate closely-held stock and other hard. The minimum funding amount to establish a charitable remainder unitrust with Stanford as.

Web Trust Amount. What types of charitable remainder trusts are available. Web Income Charitable Remainder Unitrust.

Volksentscheid Berlin Danneilazam

Lunscet09zxs M

Charitable Income Tax Deduction Comparison Calculator Us Charitable Gift Trust

Charitable Remainder Trust Calculator

Charitable Income Tax Deduction Comparison Calculator Us Charitable Gift Trust

When To Use Charitable Remainder Trusts Morningstar

Charitable Remainder Trust

Charitable Income Tax Deduction Comparison Calculator Us Charitable Gift Trust

Charitable Income Tax Deduction Comparison Calculator Us Charitable Gift Trust

Actec Proposal To Amend Charitable Remainder Trust Requirements Resources The American College Of Trust And Estate Counsel

Charitable Remainder Unitrust University Of Virginia School Of Law

Charitable Remainder Unitrust Calculator Jewish Federation Of Metropolitan Detroit

Charitable Remainder Unitrust University Of Wisconsin Foundation

:max_bytes(150000):strip_icc()/HowtoDonateStockOtherAssets-ec7555c86b91429291219f499ace01a7.jpg)

How To Donate Stock And Other Financial Gifts

Charitable Remainder Trust Calculator

Crut Charitable Remainder Unitrust Leimberg Leclair Lackner Inc

Establishing A Charitable Remainder Trust Goshen College